5 Reasons You Should Use an Early Education Advisor

A lot of expertise, experience, time and effort is required when managing the sale or gaining an investor for an early education business. Some owners try to go it alone — dealing directly with a prospective buyer or investor and avoiding any transaction fees.

However, a lack of knowledge about the market, valuation methodologies, industry transaction norms, and the overall sales process — including managing complicated legal documents and the Quality of Earnings process — often leaves owners getting less value than they would have even with an advisor managing the transaction. Below are five reasons why hiring a transaction advisor could actually put more money in your pocket:

Business Valuation – A knowledgeable advisor, especially one who operates in the early education industry, can review your financial statements and overall business structure and set realistic expectations for a purchase price. They can also present numbers in a way that maximizes value and make suggestions on how to make your business more attractive and more valuable to potential buyers and investors.

Marketing – A transaction advisor with industry experience will have a pool of buyers and investors to market your business to as well as know how to effectively market your business — usually with a professional Offering Memorandum (OM). An OM is an in-depth marketing piece highlighting important business information and assets that help attract a larger pool of buyers and investors for a more competitive process.

Confidentiality – Professional advisors are skilled at keeping a potential sale confidential. They know the importance of confidentiality — especially with employees and families — and can ensure your day-to-day operations aren’t disrupted during the process. Non-Disclosure Agreements are signed before any identifying details are disclosed, protecting both you and your business.

Competitive Process – The larger the pool of prospective buyers and investors, the more competition, resulting in a higher selling price and more options for a great culture fit. A seasoned advisor can be extremely helpful in managing competitive bidding and negotiations to get you maximum value for your childcare business.

Transaction Management – While oftentimes overlooked, an advisor team’s main strength is in managing the transaction process and acting as a buffer between the buying/investing and selling parties. Transaction teams are extremely skilled in calming tensions and managing difficult situations — negotiating and problem-solving on your behalf. In addition, an experienced advisor can provide valuable information on the transaction habits of each buyer/investor to better prepare and potentially streamline your process.

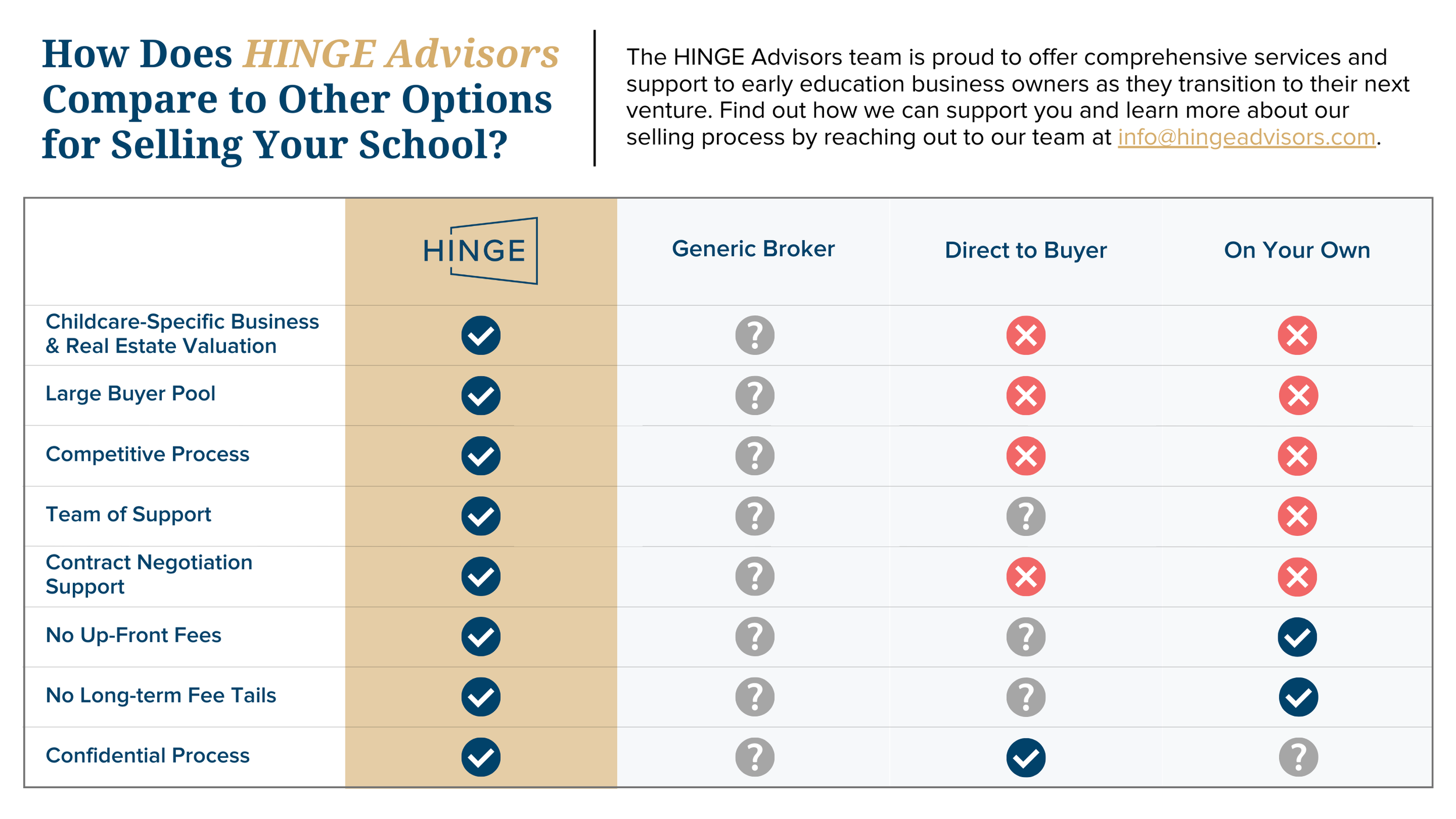

An effective advisor will ensure a smooth process, safeguard confidentiality, and get you maximum value for your business. With more than 300 years of combined experience in the early education industry, HINGE Advisors has strong relationships with 500+ active buyers and has successfully closed more than 300 school transactions. We also execute seller-friendly contracts with no up-front fees and no longterm tails on commissions. The HINGE team takes the risk alongside you and doesn’t get paid until you do! If you’re interested in learning more about our selling process, please contact our team at info@hingeadvisors.com.