Financial Coaching

In the childcare industry, profit can sometimes be viewed as a negative word. But you cannot carry out the mission you got into this industry for without financial health. Quality and profitability aren’t at odds with each other—you must be financially healthy to provide excellent care and education to the children in your care. At HINGE, we want to help you bridge the gap between simply managing your numbers and actually understanding them. From QuickBooks® Online training and cleanup to cash flow management to long-term financial planning, the HINGE team provides custom solutions to ensure your success.

Meet Our Financial Coaching Team

Kristine Mehler has a passion for educating small business owners on how best to become financially fit. With more than 30 years' experience in the accounting industry and now as Success Services Financial Leader for HINGE Advisors, Kristine is focused on helping early education business owners become more profitable professionals by teaching them effective cash management strategies. Kristine is a certified QuickBooks ProAdvisor and Training Director for QB Express and Intuit Education.

Stephanie Thompson graduated from Virginia Commonwealth University with a degree in Accounting. After graduating, she worked at a multi-state childcare company for 16 years, working her way up to the role of Controller. During her time in that role, she worked in accounting, budgeting, payroll, HR, benefits, marketing, website development, and worked directly with the Admin teams at each school to help obtain efficiencies in policy and procedure, as well as the day-to day operations of running a childcare center.

Zach Mehler works alongside Kristine and Stephanie as a Success Services Financial Coach for HINGE Advisors. Now, with almost 5 years working directly with small business owners and advising them on financial best practices, Zach is well-versed in helping his clients create more sustainable cash flows for their businesses and providing accountability when they need it most. Zach graduated from the University of Nevada earning his Bachelor's degree in Accounting and Finance.

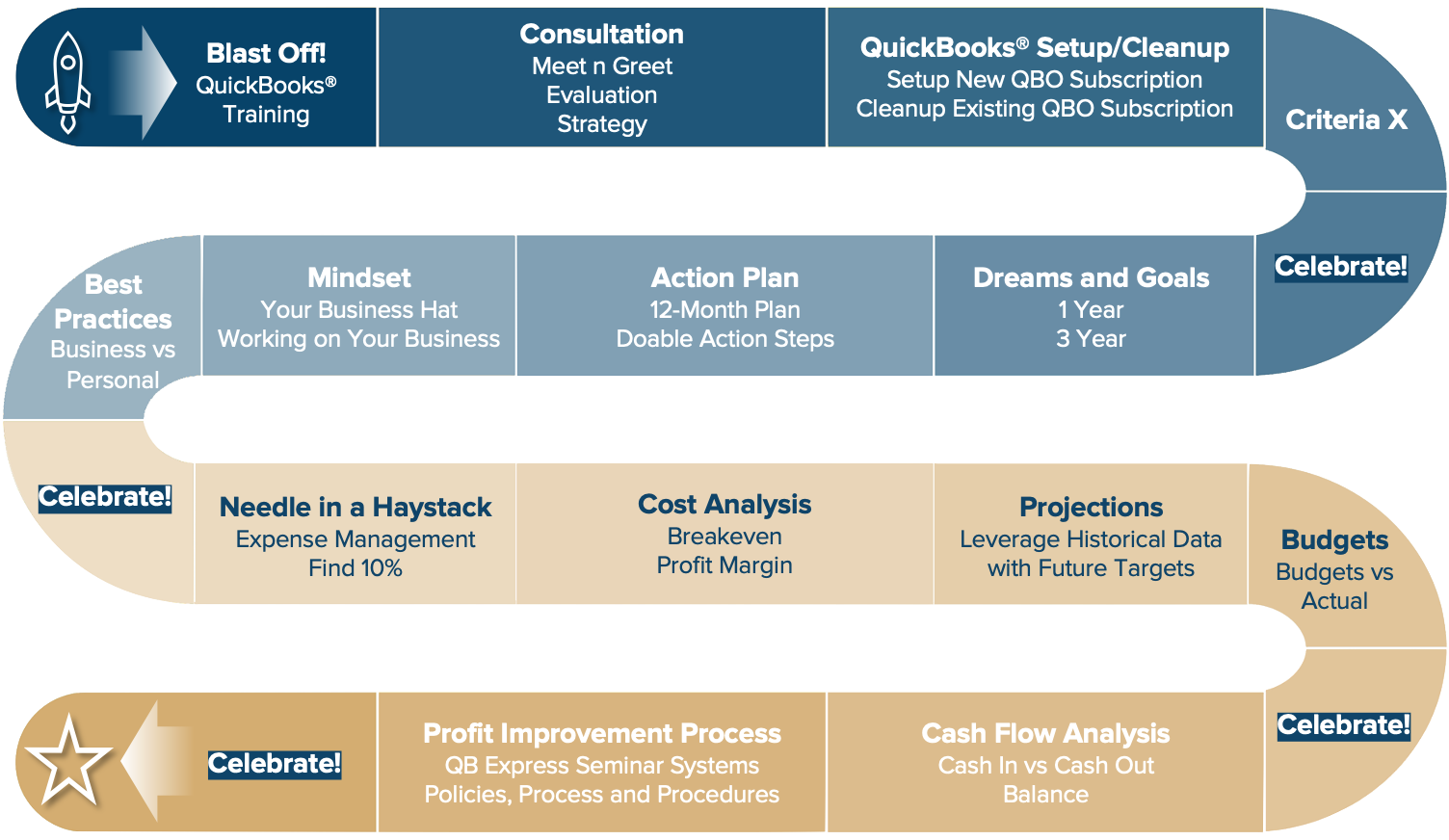

The Financial Journey

Do you use QuickBooks®? Do you trust your numbers? Have you confirmed all Balance Sheet and Profit & Loss totals are correct? Do you have policies, processes and procedures for the financial side of your business? Do you know your breakeven? What about your profit margin? Do you keep business and personal transactions separate?

There’s a lot to pay attention to when it comes to your childcare business’ finances, and it helps to have a knowledgeable team on your side to inform you on best practices, hold you accountable when you need it, and celebrate wins with you along the way. Partner with HINGE Advisors’ Financial Coaches and get started on your Financial Journey today!

Blast Off! QuickBooks® Online Training Course for Childcare Business Owners

Learn more about the capabilities of QuickBooks® Online and align your school’s financials with HINGE Advisors’ tried-and-true early education benchmark.

2-Hour Custom QuickBooks Online Training Led by a Certified Intuit QuickBooks ProAdvisor

Master the Fundamental Tools of QBO’s Accounting Software and the Major Financial Benefits it Provides

Receive our Custom QuickBooks Online Training Manual for Childcare Business Owners

Our next course begins on Tuesday, May 21st at 12:00 - 2:00pm ET!

What Our Clients Are Saying…

“It’s nice to look into the whole business... really helpful to get everything together. They helped me create a budget for the tuition side. They helped me hone in on purchasing and do a cost analysis to see if I’m getting enough in tuition. All those extra things that you might not think of and have someone to bounce ideas off of and have that support is really helpful.”

“I love how knowledgeable Zach is. He’s teaching me a lot as I go. I appreciate his patience. I like how it’s a system. As soon as I have the meeting, all the documents go to the canopy to review. Once it’s submitted I get an email, so I can stay on top of things”

“I don’t have a financial background at all. I feel my understanding of how business finances has worked has changed entirely. That’s been a huge change from using the CPA I was using of just putting the numbers in Quickbooks. Now they’re having me look at the big picture and how to cut costs so we can pay staff more.”